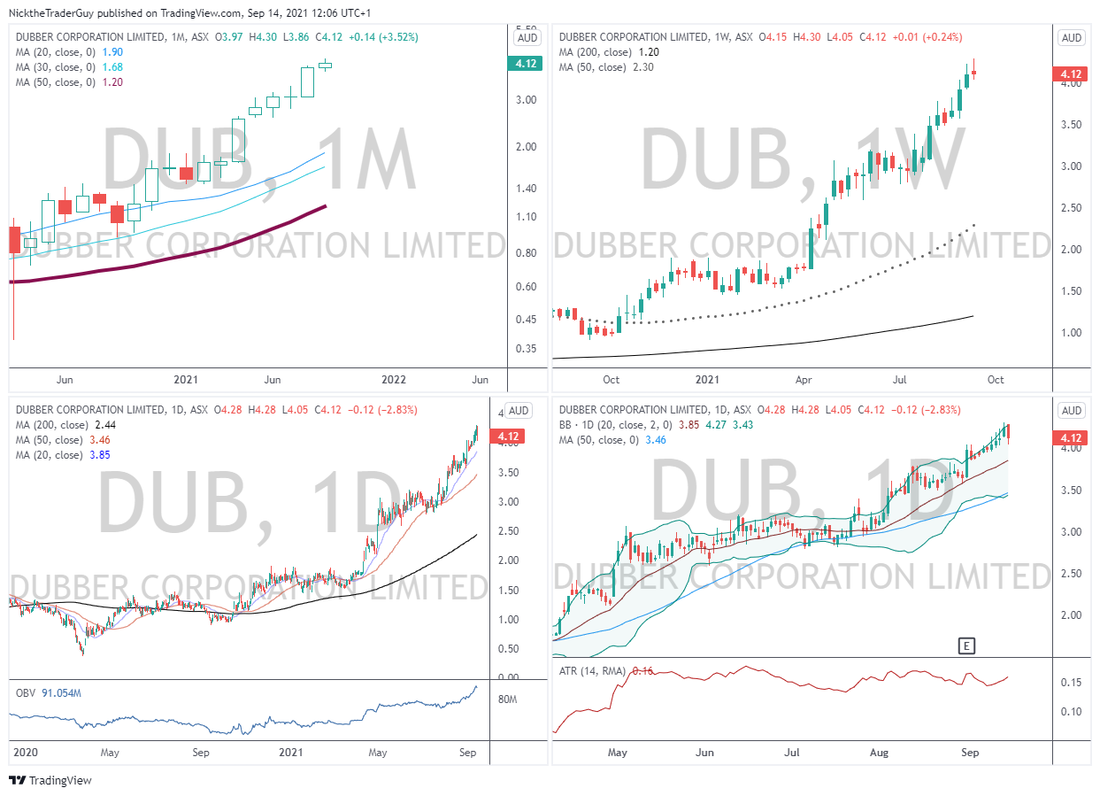

First up, apologies for the long delay since my last post, life got in the way over the last couple of months. I'm still trading and growing my capital, so it's all good! As alluded to on the main page, in this post I am going to talk a little about my process (in broad detail). I've got a few different entry methodologies that I use to identify trades. In this post I'm going to focus on my Breakout methodology. Part 1 - Instrument Selection (Breakout Methodology) . When I first started trading, I'd simply choose a stock based on what was moving that day. There was no forward planning, no though beyond, "shit, that stock's moving today, I'll buy some shares and hope for the best." Needless to say this strategy was profitable in short term but horrible in the longer term These days, I plan all my stock picks in advance. Each weekend (usually Sunday night), I'll do a stock screen generally looking for stocks which have unusual volume and momentum. I then put this stocks on what I call my first cut watch list. I'll also do a similar screen of the futures markets, but I don't worry so much about volume with stocks, its more just momentum and trend. Once I've populated my first cut watch list, I pull up my charts. I use a four pane set up in trading view looking at Monthly, Weekly and then 2 daily charts (one zoomed in and one zoomed out). I look for stocks which have been trending well in the past on the monthly and weekly charts and a clear trend on the daily (steady momentum in the trend direction). If I see this, the stock gets added to my Trade Watch List. From there I monitor the stock following the open on Monday and will generally enter a trade after the first hour of trade has passed. That it, I try and keep in simple with my instrument selection. All in all I spend about an hour a week reading the charts and determining trade set-ups. Here's an example of my chart set-up. You can see I keep my charts simple a few Moving Averages as indicators and a Bollinger Band for an indication of volatility. Happy Trading Cheers Nick the Trader Guy 14 September 21

0 Comments

Leave a Reply. |

Archives

February 2023

Categories |

RSS Feed

RSS Feed